Robin AI — A Cautionary Tale in Legal-Tech and Generative AI

1. Company Snapshot

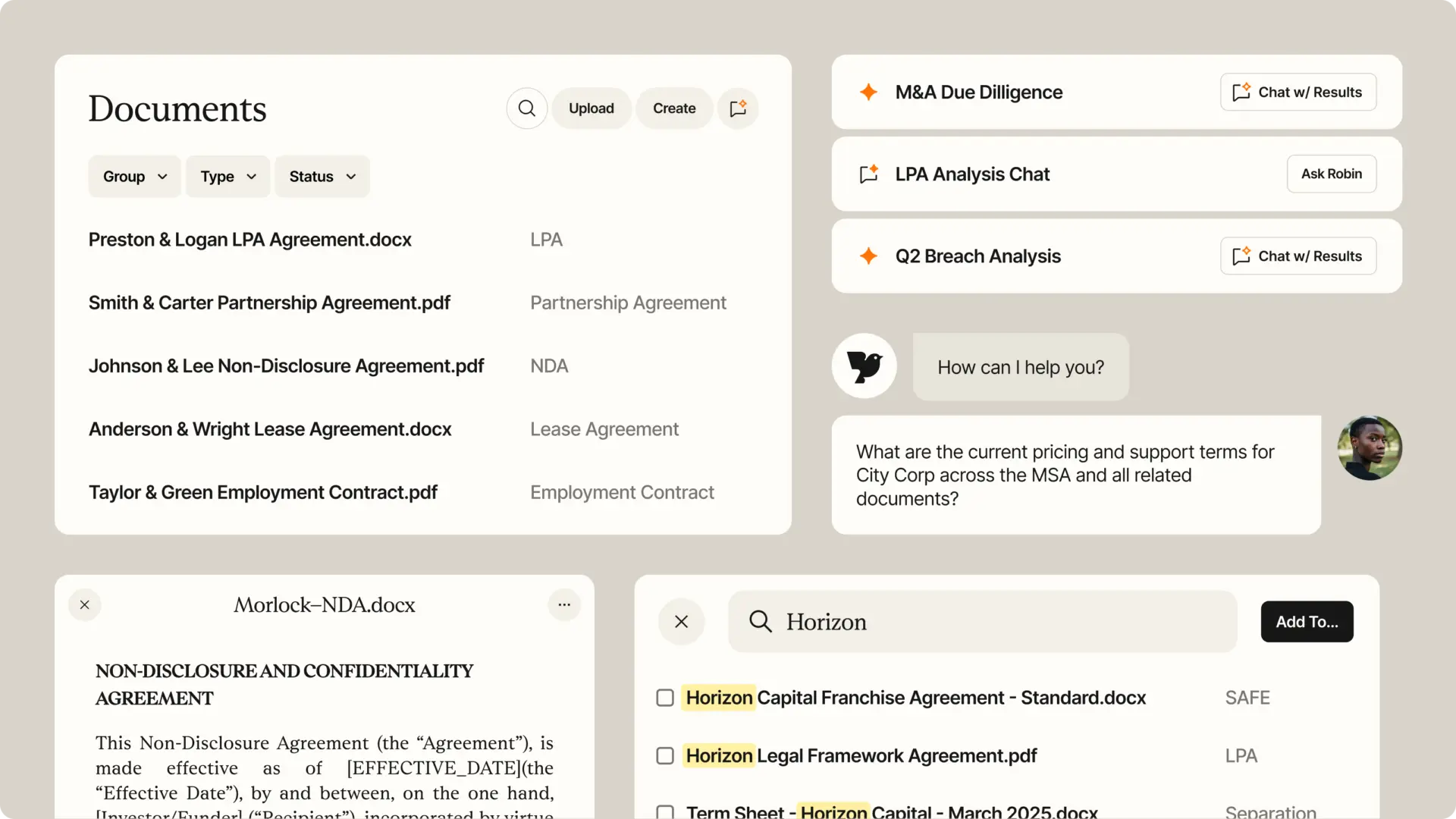

Founded in 2019 by Richard Robinson, a former lawyer, and James Clough, a machine learning researcher, Robin AI aimed to integrate artificial intelligence with corporate legal services. Its core proposition was to combine machine learning models with human expertise to assist corporate legal teams in reviewing contracts, managing risk, and scaling operational processes.

Key early highlights include:

- Raising US $25 million in late 2024, following a US $26 million Series B earlier that year ([Fortune][2]).

- Securing enterprise clients such as Pfizer, KPMG, and UBS, emphasizing its “AI-native” design for corporate legal departments rather than traditional law firms ([Robin][1]).

- Maintaining offices in London (headquarters), New York, and Singapore ([Robin][1]).

At the time, Robin AI’s growth trajectory appeared promising, combining an underserved legal-tech vertical with the rising interest in generative AI.

2. Challenges and Operational Setbacks

Despite early optimism, several developments in 2025 altered Robin AI’s trajectory.

Funding and Growth Shortfall

- The company reportedly failed to secure a planned ~US $50 million funding round ([Sifted][3]).

- Subsequent layoffs affected approximately one-third of staff (~50 roles), with reports suggesting nearly 200 jobs could be at risk as Robin AI appeared on a “rescue/insolvency” marketplace for sale ([BusinessCloud][4]).

Leadership Changes

- Co-founder and CTO James Clough departed; his successor, Tramale Turner, remained under one year ([Artificial Lawyer][5]).

- The Head of Communications also exited amid restructuring efforts ([Artificial Lawyer][5]).

Strategic and Market Challenges

- Expansion into corporate legal departments faced slower-than-expected adoption due to lengthy sales cycles, enterprise inertia, and increased competition ([Law News and Jobs][6]).

- Strategic partnerships, such as with Dye & Durham, reportedly failed to deliver anticipated synergies ([Artificial Lawyer][5]).

- The promise of “AI solving legal workflows” confronted the reality of risk-averse corporate clients and the difficulties of achieving scale ([Law News and Jobs][6]).

3. Implications and Analysis

For Robin AI

The company appears to be moving towards an exit strategy rather than additional growth financing. Its struggles illustrate how even well-capitalized startups may falter when product-market fit, go-to-market execution, and enterprise expansion lag behind market expectations.

For the Legal-Tech and Enterprise AI Market

- Hype versus execution: Generative AI’s potential in legal workflows is evident, but successful implementation remains challenging. Funding alone cannot compensate for insufficient revenue traction.

- Enterprise adoption barriers: Corporate legal departments are conservative and require strong evidence of value. Scaling beyond initial pilot programs is difficult.

- Market consolidation: Numerous vendors targeting similar niches may lead to consolidation. Robin AI’s challenges could foreshadow broader market corrections.

- Leadership and unit economics: Rapid hiring, leadership turnover, and high cash burn increase vulnerability when fundraising conditions tighten.

For Investors and Practitioners

- Metrics such as bookings growth, net retention, sales cycle duration, and customer expansion are critical indicators beyond headline AI claims.

- Human-in-the-loop models remain essential in regulated industries; operational rigor is as important as technical sophistication.

- The venture funding environment for AI startups is shifting from “growth at any cost” to prioritizing profitability and sustainable scaling.

4. Key Developments to Monitor

- Exit outcomes: Acquisition, wind-down, or business model pivot will offer insights for similar startups.

- Customer retention: The degree to which enterprise clients continue and expand usage will indicate product viability.

- Competitive response: How rival vendors adjust strategy, pricing, and partnerships will shape market dynamics.

- Sector trends: Robin AI may serve as an early indicator of potential corrections in the legal-tech AI space.

5. Lessons for Practitioners

The Robin AI case underscores several takeaways relevant to AI product leaders and enterprise technology developers:

- Integration of domain expertise and engineering: Technical capability must align with workflow, trust, and human-in-the-loop design.

- Enterprise go-to-market strategy: Selling to conservative corporate teams requires more than technological innovation; it demands understanding operational realities.

- Scaling from proof-of-concept to enterprise deployment: Converting demos into measurable business value is challenging and critical.

- Financial discipline and growth pacing: Rapid scaling increases complexity and cash burn; incremental, disciplined growth may mitigate risk.

- Human-AI balance: Systems that combine human oversight and AI require careful design to deliver operational efficiency and cost-effectiveness.

Glossary

- AI-native: Software built from the ground up to leverage artificial intelligence as a core feature.

- Generative AI: AI models capable of producing content, including text, images, and structured outputs.

- Human-in-the-loop (HITL): Systems where humans validate, oversee, or supplement AI decision-making.

- Series B funding: The second significant round of venture capital financing, typically used to scale operations.

- Enterprise adoption: The process of large organizations integrating a technology or service into their workflows.

- Unit economics: Financial metrics that measure the profitability and sustainability of a business on a per-unit basis (e.g., per customer).